AMD 2017 Q2财报相关信息、Q&A等总结

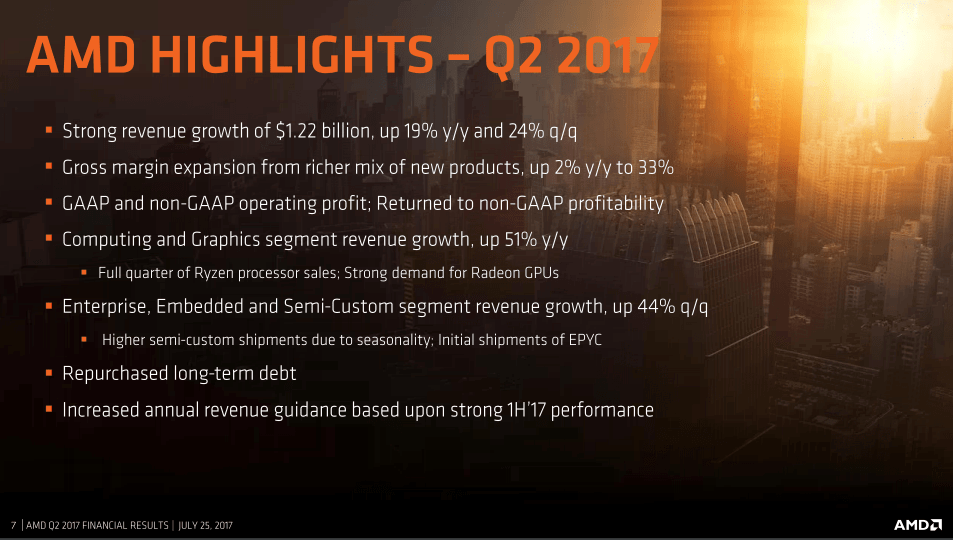

2017 Q2营收增长 19%

3年内首次实现运营盈利

Ryzen + 图形业务营收两位数增长 = 计算与图形业务营收16年同期增长51%

客户计算营收两位数增长

所有主要OEM都发布了基于Ryzen的产品

按时发布Ryzen系列产品

产品:

Threadripper = 八月

Ryzen Pro = Q3

Raven Ridge = Q3

图形 = 出货量增加,游戏和虚拟货币为主要驱动力

苹果使用Radeon显卡

Vega FE 6月发布,数据中心有部分销量

Radeon Instinct服务器达成100TFLOPS

EPYC收入未知

主机 = 出货6000万台PS4, XBOX One X 今年Q4

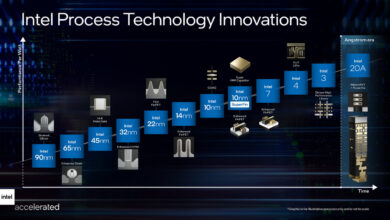

EPYC:

数据中心有160亿的潜在市场

各个价位都提供更好性能

单路、双路相当(拓展性能)

20多个服务器制造商展示EPYC平台及对其的优化支持

OEM,云服务提供商和大数据中心也有支持

今年晚些时候还有20多个新的EPYC平台

重返数据中心市场,势头强劲

Q&A:

“EPYC的接受程度如何?何时投入生产环境?”

A: “很受欢迎,包括许多友商、OEM和ODM。他们很感兴趣,增加了额外的客户支持以确保平台稳定性。这方面的营收会在今年下半年继续增加 – 验证需要最多4个季度,在数据中心方面开始增长之前需要时间。”

“虚拟币提升了GPU销量,但也是把双刃剑 – 对于矿工和二手卡方面有措施吗?”

A: “RX500系列有更好的性能,定位很好(游戏和挖矿),我们正准备补货,专注游戏市场 -这是我们的核心市场。和主要零售商一起向游戏市场供货。我们没有预见到虚拟币的爆发,也不觉得会长久,但我们会留意”

“长期路线图,尤其是企业…客户对你们发布的产品有多大信心?”

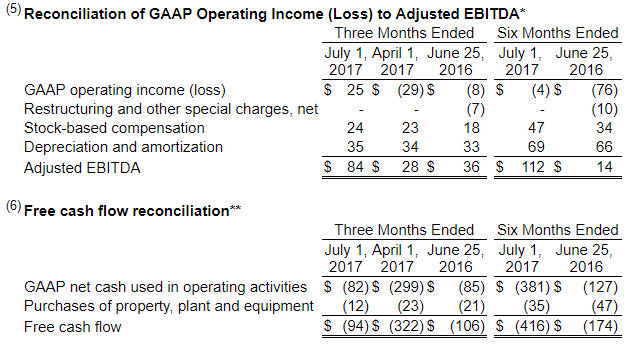

A: “客户知道Ryzen EPYC和Vega有性能,路线图很稳健,为了下代Ryzen我们在7nm上投入很大力量。我们在多家代工厂和多个设计队伍上同时进展,保持下几代的竞争力。“

“客户ASP’s, Ryzen做得怎样”

A: “现在还太早但OEM已经发布了产品,刚开始增加产量。移动ASP方面,以前的产品略有下降。然而Ryzen在OEM领域马上会起飞,尤其是Q3发布Ryzen移动版 APU之后。”

“全年毛利预期没增加,为什么?”

A: “到Q3 ER会有更多信息,需要时间”

“Vega游戏卡马上开卖,怎么样?”

A: “Vega将在Q3进入游戏和其他领域”

“Ryzen笔记本什么时候到来?”

A: “圣诞节前后,2017H2”

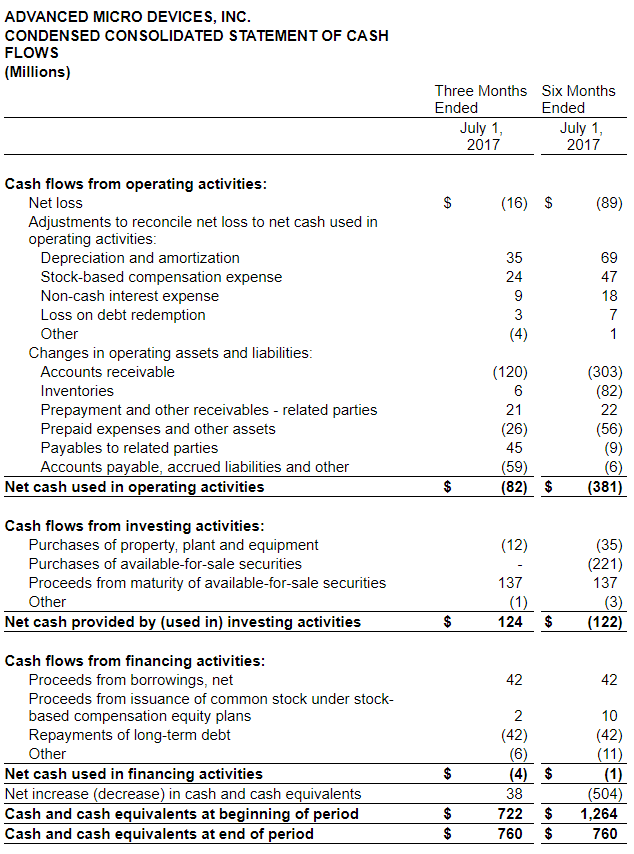

“自由现金流又是负的,何时转正?”

A: “下季度。目前由于生产和开发成本所以是负的。与前几年不同,设计上的成功和需求增加导致增长。产品比以前强了许多。AIB在决定产品特性时扮演主要角色。”

“库存下降了,为什么”

A: “营收增长、业务实力等等导致的。Q3 Q4一样。”

A: “Epyc比其他产品线增长要慢。【已经说过,验证周期更长】”

“为了回到原来AMD在数据中心的市场份额,AMD正在做出哪些努力?”

A: “Epyc的性能很重要,云数据中心是一块大蛋糕。他们控制自己的软件,因而验证周期更快。客户认可了EPYC的价值,我们想要尽快增加这方面的营收。”

“竞争对手呢?你们计划有改变吗?”

A: “我们专注在我们的信条上:产品的竞争力”

“明年Epyc会主要被云服务还是企业采用?

A: “大量客户和顶级云服务提供商目前对EPYC很感兴趣,比如微软Azure,百度以及一些其他云服务商…OEM需求很大,惠普企业,戴尔等。两头都很重要,云服务营收可能更多,有待观察。”

“显卡供求问题?”

A: “没料到需求会这么大,已经开始努力提升产量。我们通常就在每年这时候提升产量,只是碰巧比预料的要早。”

“客户对于MCM的评价如何?”

A: “评价非常好,MCM是我们的策略,在核心和IO上给了我们极大的灵活度,正在和客户一起解决延迟方面的东西。尤其是单路服务器,客户反馈非常好,我们今年内准备尽全力出货EPYC平台。”

“Q4会影响利润吗?”

A: “一般Q3是我们的最高点,Q4会降一点。另外矿工对显卡的需求是暂时的,可能不会持续到今年底。我们的其他产品会逐渐提升产量,所以也需要考虑这些。”

“R&D的增加很好 , R&D的优先度是怎样的?”

A: “OPEX & R&D 在增加, 这是经过考虑的。我们将会继续现有的模式。R&D集中在数据中心处理、深度学习及计算方面。我们很高兴能增加R&D,以推动高利润市场。”

“EPYC营收占比?”

A: “需要时间。EPYC在目前定价下利润很高,对客户来说性价比也很不错。”

“关于Radeon Instinct呢?”

A: “得到了很多关注,正在持续增长。但也有波动。”

“关于今年下半年,有考虚拟货币这个因素吗?”

A: “我们维持保守估计。我们无法完美细化市场,但正在和友商合作,关注其动向。我们预计需求会渐渐趋于平稳,只是不确定具体时间。”

PPT:

搜狐的新闻:

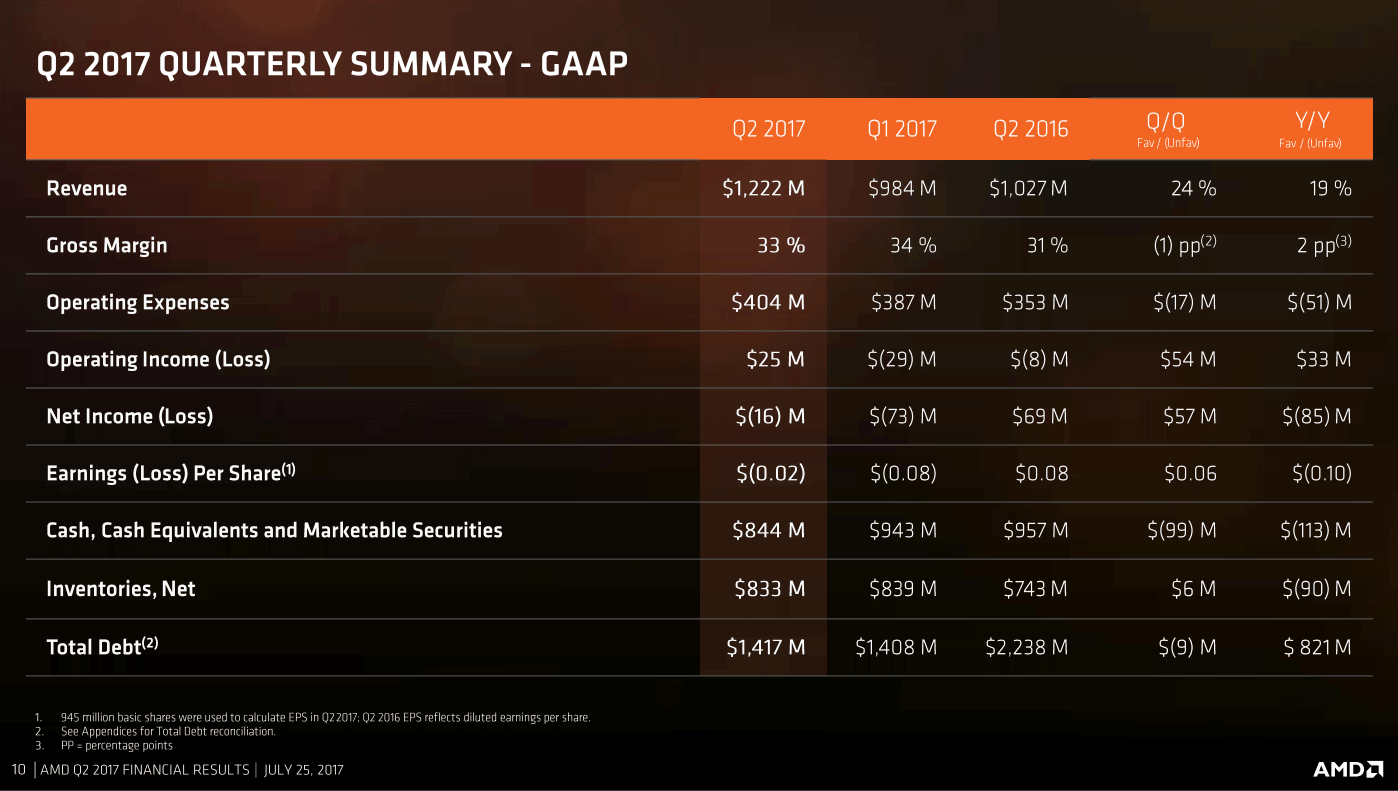

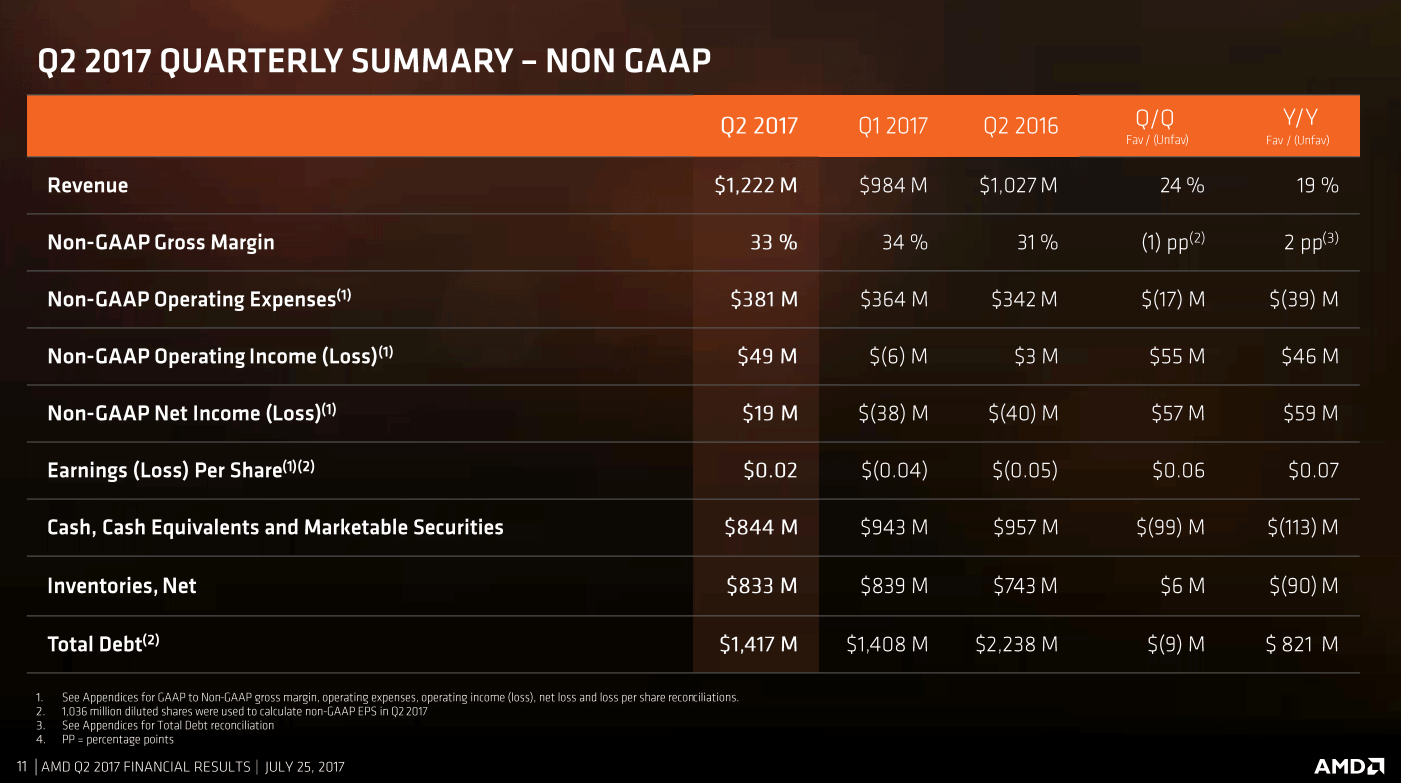

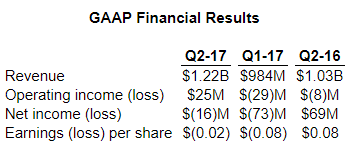

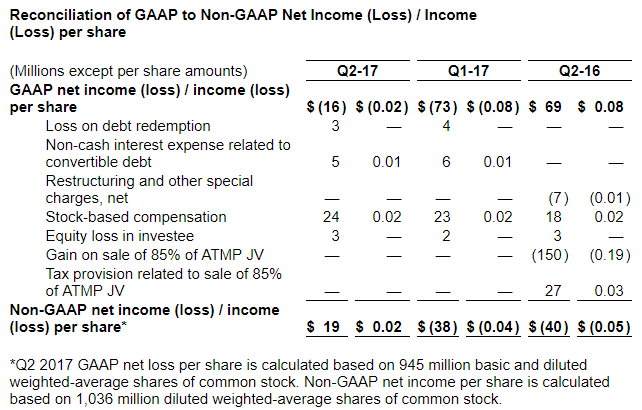

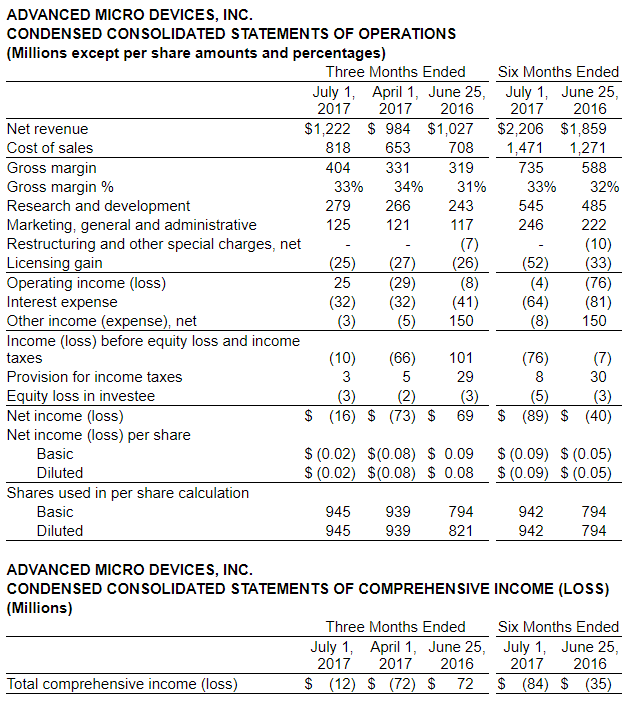

AMD今天公布了2017财年第二季度财报。报告显示,AMD第二季度营收为12.22亿美元,高于去年同期的10.33亿美元,以及上一季度的9.84亿美元;净亏损为1600万美元,相比之下去年同期的净利润为6900万美元,上一季度的净亏损为7300万美元。AMD第二季度业绩超出华尔街分析师此前预期,并上调了2017财年全年的业绩展望,从而推动其股价在盘后交易中大幅上涨近8%。

在截至7月1日的这一财季,AMD的净亏损为1600万美元,每股亏损为0.02美元,这一业绩逊于去年同期。2016财年第二季度,AMD的净利润为6900万美元,每股收益为0.08美元。不计入某些一次性项目(不按照美国通用会计准则),AMD第二季度调整后净利润为1900万美元,相比之下去年同期的调整后净亏损为4000万美元;调整后每股收益为0.02美元,相比之下去年同期的调整后每股亏损为0.05美元,这一业绩超出分析师此前预期。财经信息供应商FactSet调查显示,分析师平均预期AMD第二季度每股收益为零。

AMD第二季度营收为12.22亿美元,高于去年同期的10.33亿美元,以及上一季度的9.84亿美元,也超出分析师预期。FactSet调查显示,分析师平均预期AMD第二季度营收为11.6亿美元。

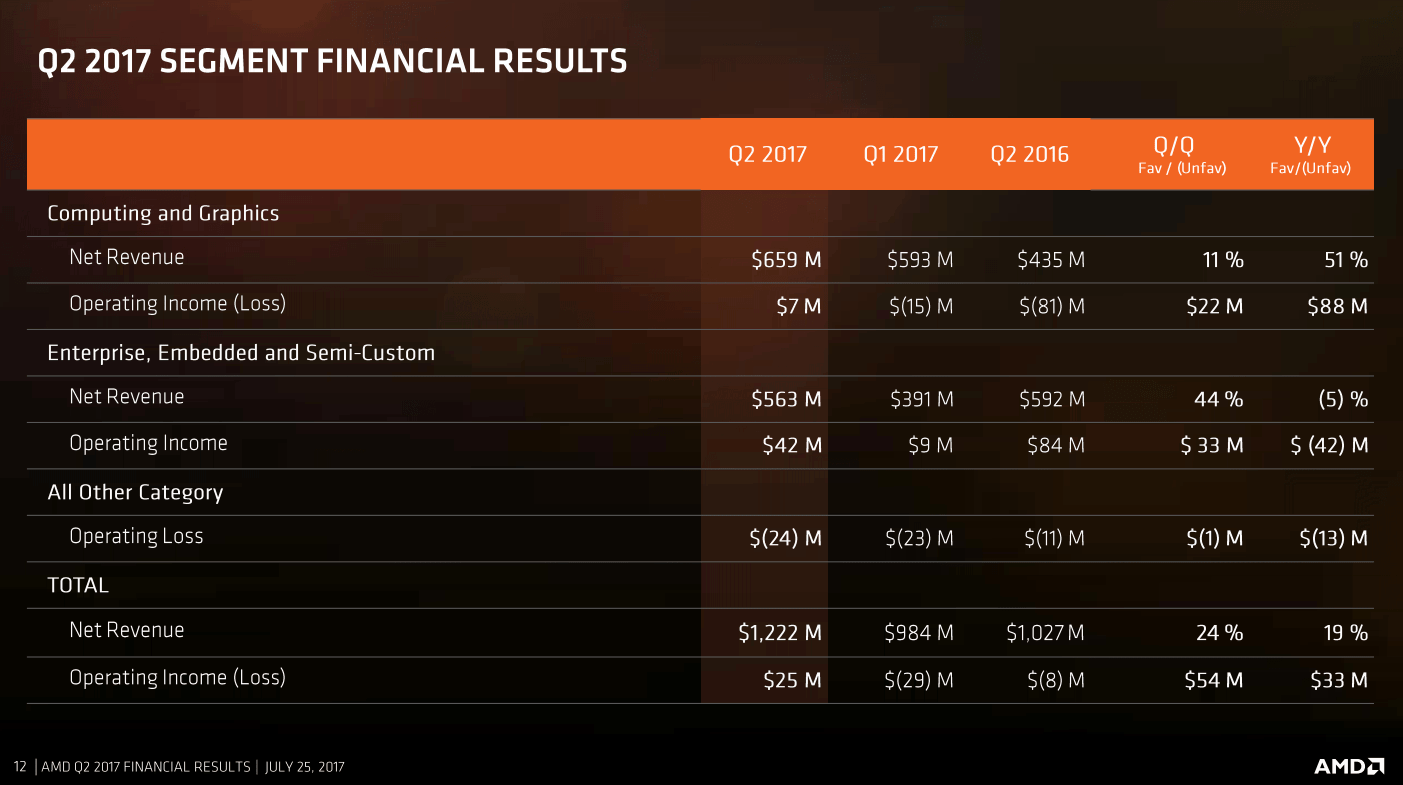

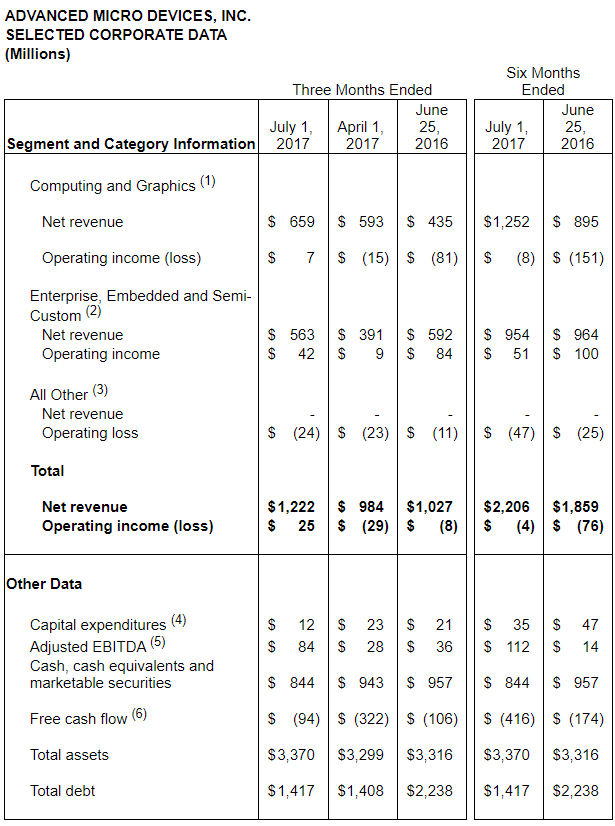

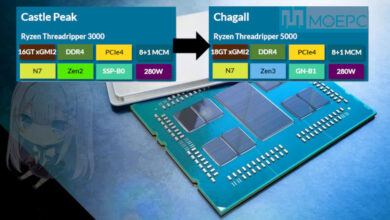

按业务部门划分,AMD第二季度来自于计算和图形部门的营收为6.59亿美元,高于去年同期的4.35亿美元和上一季度的5.93亿美元;运营利润为700万美元,相比之下去年同期的运营亏损为8100万美元,上一季度的运营亏损为1500万美元。企业、嵌入和半定制业务的营收为5.63亿美元,低于去年同期的5.92亿美元,但高于上一季度的3.91亿美元;运营利润为4200万美元,低于去年同期的8400万美元,但高于上一季度的900万美元。其他所有业务的运营亏损为2400万美元,相比之下去年同期的运营亏损为1100万美元,上一季度的运营亏损为2300万美元。

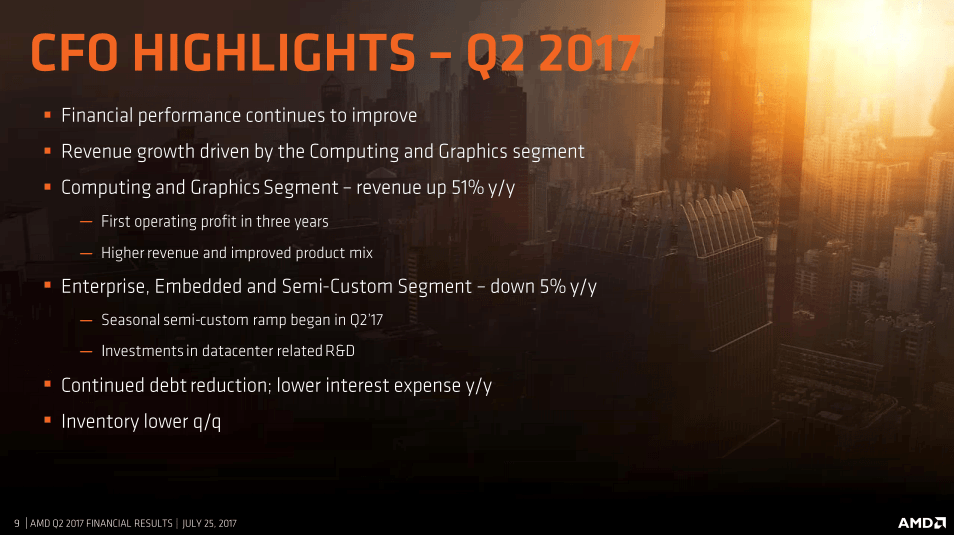

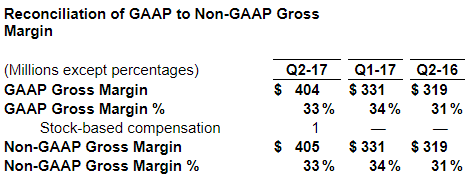

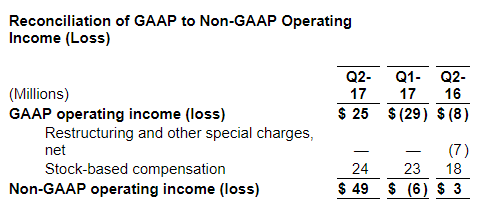

AMD第二季度运营利润为2500万美元,相比之下去年同期的运营亏损为800万美元,上一季度的运营亏损为2900万美元;不计入某些一次性项目(不按照美国通用会计准则),AMD第二季度调整后运利润为4900万美元,相比之下去年同期的运营利润为300万美元,上一季度的运营亏损为600万美元。AMD第二季度毛利率为33%,同比上升2个百分点,但环比下降1个百分点。

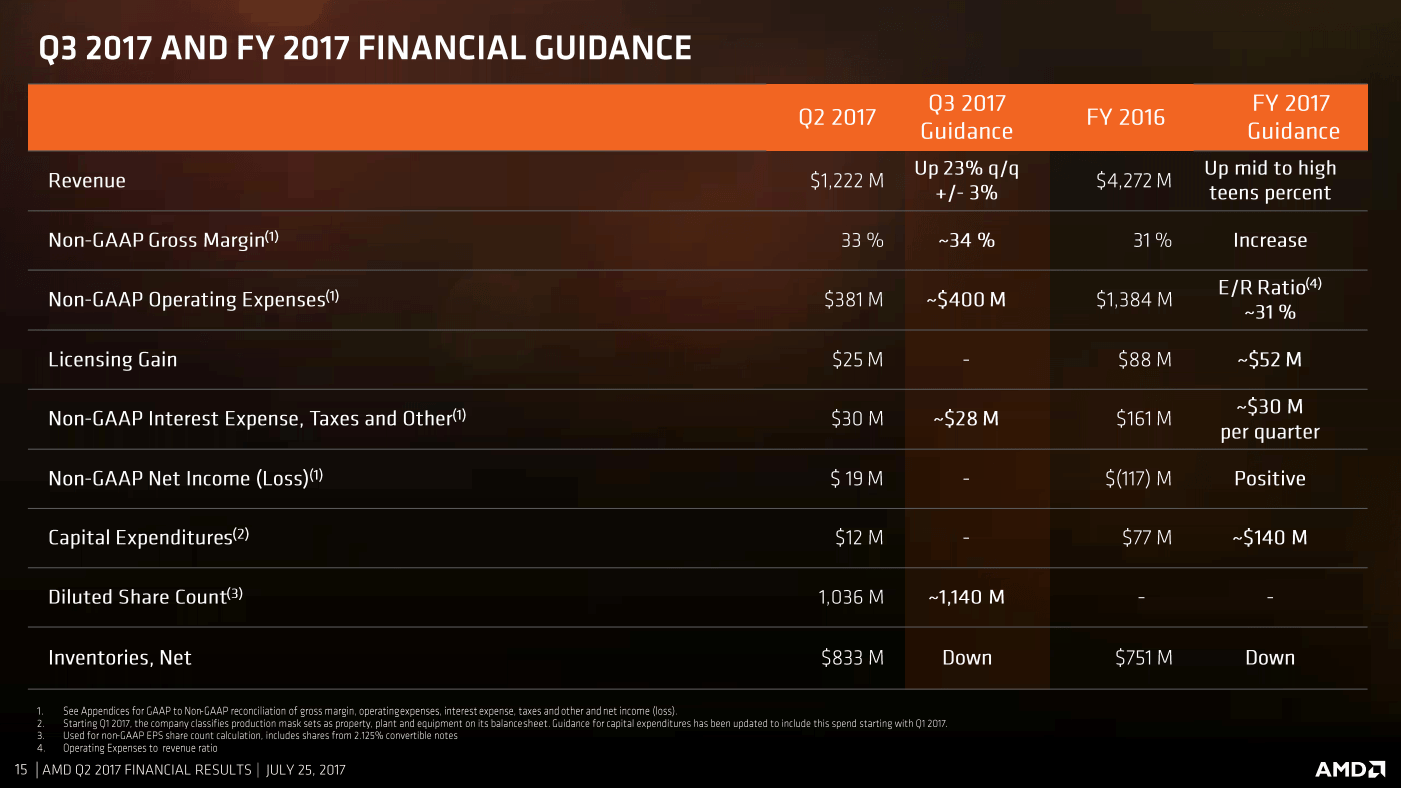

AMD预计,2017财年第三季度营收环比增长约23%,上下浮动3个百分点,按其中值计算同比增长约15%。AMD还预测,2017年全年的营收增幅将在10%到19%区间的中到高段,相比之下此前预期为将可实现较低的两位百分数增长。

AMD PR原文:

AMD Reports Second Quarter 2017 Financial Results

– Revenue Increased 19 Percent Year-over-Year –

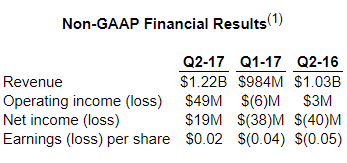

SUNNYVALE, Calif., July 25, 2017 (GLOBE NEWSWIRE) — AMD (NASDAQ:AMD) today announced revenue for the second quarter of 2017 of $1.22 billion, operating income of $25 million, and net loss of $16 million, or $(0.02) per share. On a non-GAAP(1) basis, operating income was $49 million, net income was $19 million, and earnings per share was $0.02.

“Our second quarter results demonstrate strong growth driven by leadership products and focused execution,” said Dr. Lisa Su, AMD president and CEO. “Our Ryzen desktop processors, Vega GPUs, and EPYC datacenter products have received tremendous industry recognition. We are very pleased with our improved financial performance, including double digit revenue growth and year-over-year gross margin expansion on the strength of our new products.”

Q2 2017 Results

On a GAAP basis, revenue was $1.22 billion, up 19 percent year-over-year, driven by higher revenue in the Computing and Graphics segment. Revenue was up 24 percent sequentially, driven by increased sales in both business segments. Gross margin was 33 percent, up 2 percentage points year-over-year due to a richer product mix and a higher percentage of revenue from the Computing and Graphics segment, driven by the first full quarter of Ryzen processor sales. On a sequential basis, gross margin declined 1 percentage point due to a higher percentage of revenue from the Enterprise, Embedded and Semi-Custom segment. Operating income was $25 million compared to an operating loss of $8 million a year ago and an operating loss of $29 million in the prior quarter. Net loss was $16 million compared to net income of $69 million a year ago and a net loss of $73 million in the prior quarter. Loss per share was $0.02 compared to diluted earnings per share of $0.08 a year ago (which included a pre-tax gain of $150 million related to our ATMP JV transaction) and a loss per share of $0.08 in the prior quarter.

On a non-GAAP(1) basis, operating income was $49 million compared to operating income of $3 million a year ago and an operating loss of $6 million in the prior quarter. Net income was $19 million compared to a net loss of $40 million a year ago and a net loss of $38 million in the prior quarter. Diluted earnings per share was $0.02 compared to a loss per share of $0.05 a year ago and a loss per share of $0.04 in the prior quarter.

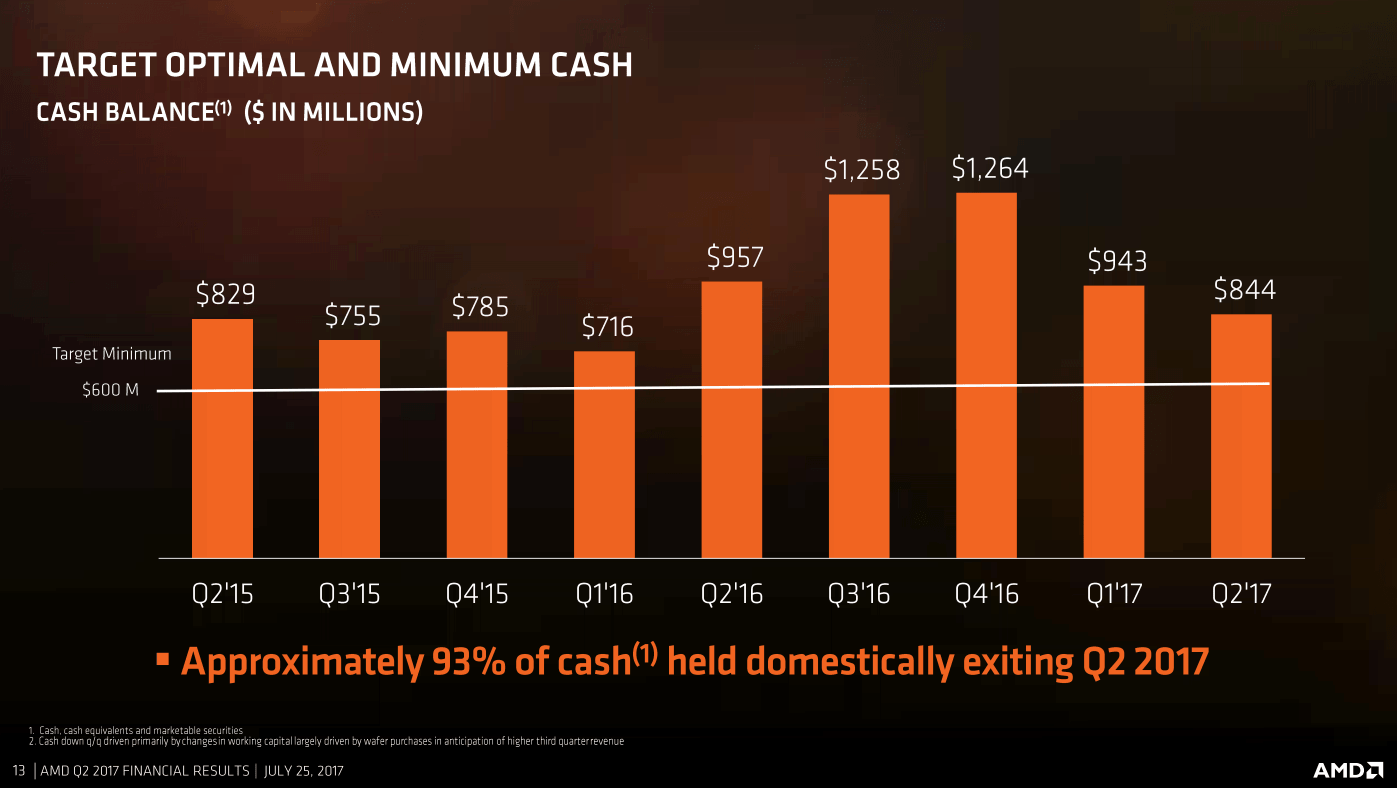

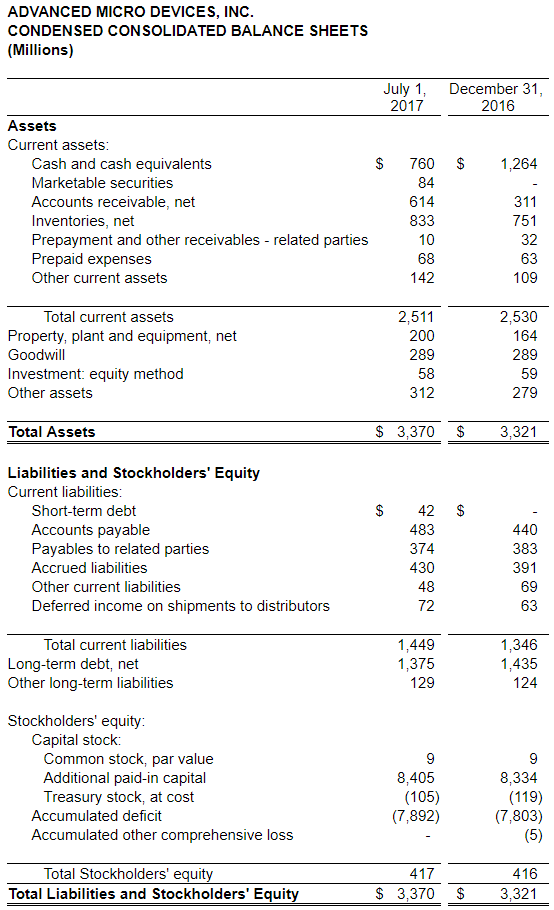

Cash, cash equivalents, and marketable securities were $844 million at the end of the quarter, compared to $943 million in the prior quarter.

Quarterly Financial Segment Summary

? Computing and Graphics segment revenue was $659 million, up 51 percent year-over-year, driven by demand for graphics and Ryzen desktop processors.

Operating income was $7 million, compared to an operating loss of $81 million in Q2 2016. The year-over-year improvement was driven primarily by higher revenue and improved product mix.

Client average selling price (ASP) increased significantly year-over-year, as desktop processor ASP increased due to the first full quarter of Ryzen processor shipments.

GPU ASP increased year-over-year.

? Enterprise, Embedded and Semi-Custom segment revenue was $563 million, down 5 percent year-over-year primarily due to lower semi-custom SoC sales. In the quarter, AMD reached an important milestone by recognizing initial revenue from EPYC datacenter processor shipments.

Operating income was $42 million, compared to operating income of $84 million in Q2 2016. The year-over-year decrease was primarily due to lower revenue and higher datacenter related R&D investments.

? All Other operating loss was $24 million compared with an operating loss of $11 million in Q2 2016. The year-over-year difference in operating loss was related to stock-based compensation charges and a $7 million restructuring credit in Q2 2016.

Q2 2017 Highlights

AMD launched its new “Zen” architecture-based EPYC? 7000 series processors, returning innovation and choice to the x86 server market with record setting single and dual-socket performance and product introductions from 10 of the world’s largest server manufacturers.

AMD introduced its upcoming high-end desktop solution targeted at the world’s fastest ultra-premium desktop systems, the Ryzen? Threadripper? CPU.

AMD unveiled new details about its upcoming Ryzen? 3 desktop CPUs.

AMD launched its Ryzen? PRO desktop processors, designed to bring reliability, security, and performance to enterprise desktops.

AMD announced that Radeon Instinct? accelerators, including Radeon Instinct MI25, MI8, and MI6, together with AMD’s open ROCm 1.6 software platform, will ship in Q3 2017.

AMD launched the Radeon? Vega Frontier Edition graphics card which expands the capacity of traditional GPU memory to 256TB by leveraging system memory.

AMD introduced the Radeon? RX 580 and Radeon? RX 570 graphics cards, engineered using the 2nd generation Polaris architecture for smooth gaming in leading AAA games at HD resolutions and higher.

Microsoft® unveiled new details and branding for its Xbox One X? (formerly “Project Scorpio”), which features an AMD semi-custom chip.

AMD announced that it has been selected by the Department of Energy’s Exascale Computing Project (ECP) to accelerate critical computing technology research for the development of the nation’s first exascale supercomputers.

At Financial Analyst Day, AMD detailed the next phase of its long-term growth strategy focused on delivering products and technologies for a combined $60 billion market for PCs, immersive devices, and datacenters.

AMD announced the appointment of Abhi Y. Talwalkar to its board of directors.

Current Outlook

AMD’s outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Statement” below.

For the third quarter of 2017, AMD expects revenue to increase approximately 23 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in third quarter 2017 revenue increasing approximately 15 percent year-over-year. AMD now expects annual revenue to increase by a mid to high-teens percentage, compared to prior guidance of low double digit percentage revenue growth.

For additional details regarding AMD’s results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

AMD Teleconference

AMD will hold a conference call for the financial community at 2:00 p.m. PT (5:00 p.m. ET) today to discuss its second quarter 2017 financial results. AMD will provide a real-time audio broadcast of the teleconference on the Investor Relations page of its website at www.amd.com. The webcast will be available for 12 months after the conference call.

1.In this earnings press release, in addition to GAAP financial results, AMD has provided non-GAAP financial measures including non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP earnings (loss) per share. These non-GAAP financial measures reflect certain adjustments as presented in the tables in this earnings press release. AMD also provided adjusted EBITDA and free cash flow as supplemental non-GAAP measures of its performance. These items are defined in the footnotes to the selected corporate data tables provided at the end of this earnings press release. AMD is providing these financial measures because it believes this non-GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance and for the other reasons described in the footnotes to the selected data tables. Refer to the data tables at the end of this earnings press release.

See footnotes on the next page

(1 ) The Computing and Graphics segment primarily includes desktop and notebook processors and chipsets, discrete graphics processing units (GPUs) and professional graphics processors.

(2 ) The Enterprise, Embedded and Semi-Custom segment primarily includes server and embedded processors, semi-custom System-on-Chip (SoC) products, development services and technology for game consoles. The Company also licenses portions of intellectual property portfolio.

(3 ) All Other category primarily includes certain expenses and credits that are not allocated to any of the operating segments. Also included in this category are stock-based compensation expense and restructuring and other special charges, net.

(4 ) Starting in Q1 2017, the Company classifies production mask sets as property, plant and equipment on its balance sheet.

* The Company presents “Adjusted EBITDA” as a supplemental measure of its performance. Adjusted EBITDA for the Company is determined by adjusting operating income (loss) for depreciation and amortization, stock-based compensation expense and restructuring and other special charges, net. The Company calculates and presents Adjusted EBITDA because management believes it is of importance to investors and lenders in relation to its overall capital structure and its ability to borrow additional funds. In addition, the Company presents Adjusted EBITDA because it believes this measure assists investors in comparing its performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance. The Company’s calculation of Adjusted EBITDA may or may not be consistent with the calculation of this measure by other companies in the same industry. Investors should not view Adjusted EBITDA as an alternative to the GAAP operating measure of operating income (loss) or GAAP liquidity measures of cash flows from operating, investing and financing activities. In addition, Adjusted EBITDA does not take into account changes in certain assets and liabilities as well as interest income and expense and income taxes that can affect cash flows.

** The Company also presents free cash flow as a supplemental Non-GAAP measure of its performance. Free cash flow is determined by adjusting GAAP net cash provided by (used in) operating activities for capital expenditures. The Company calculates and communicates free cash flow in the financial earnings press release because management believes it is of importance to investors to understand the nature of these cash flows. The Company’s calculation of free cash flow may or may not be consistent with the calculation of this measure by other companies in the same industry. Investors should not view free cash flow as an alternative to GAAP liquidity measures of cash flows from operating activities.

The Company has provided reconciliations within the earnings press release of these non-GAAP financial measures to the most directly comparable GAAP financial measures.

为毛没人多问问关于深度学习这么大一个市场

英伟达因为深度学习现在市值已千亿了

@NiceMing_Bear:CPU GPU性能跟上了

深度学习是水到渠成的事情

@LuluEhh:生态不是那么容易弥补的,现在用a卡跑dl还得自己造轮子

@NiceMing_Bear:NV市盈率比I/A高出许多。

Emmmm….

所以今年AMD又是运气奇好么(笑)

翻身翻了270度…很大的进展了….

不过不管怎么说能取得这个业绩也真是按摩店的一大突破了

预祝Vega能顺利(虽然可能要到9月初???

谢谢。辛苦了